PERFORMANCE UPDATE

Public SAAS Companies

CY Q2 2022

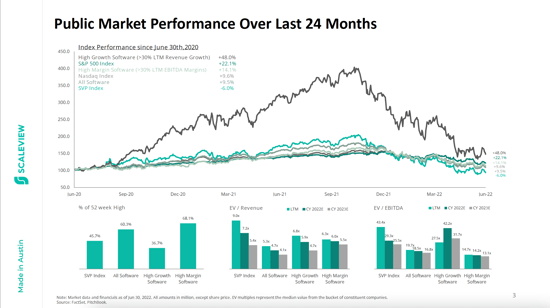

Given the continued volatility in the equity markets, we at ScaleView want to provide an update on the important metrics of leading software companies following their second quarter earnings update.

As you probably already know, the current big “risk” to software companies is earnings revision, and this quarter shows that it has not happened yet. These high growth companies have projected cash flows well into the future and investors appropriately discount those cash flows using prevailing interest rates - hence the sensitivity to rising rates!

While the bumpy ride in public markets may continue for some time, these SaaS companies have shown the ability to operate and execute well despite the economic uncertainty.

Download Now

Highlights from the Quarter

- 90% of the companies beat the consensus revenue estimates in Q2, 2022

- The median revenue growth rate stood at 31% YoY, while the median expected growth rate is 23%

- 58% of the companies reported a net revenue retention rate >120%

- Gross margin of 59% of the companies was over 70%

- High growth companies declined 63% vs. their 52-week high share price. High margin companies declined by 32%

- SVP Index universe companies trade at a median 2023E EV/Revenue of 5.4x and 2023E EV/EBITDA of 25.5x

Take the next step for your business

We’ve been where you are now. Get the guidance we wish we’d had back then.